Some Medicare items have derived items with a fee that is a percentage of the original fee. These items are used in specific circumstances, such as an additional patient being seen or an on-site visit to a hospital, aged care facility or home visit.

Zedmed also supports percentage adjustments to approved fees for Health Funds.

The Medicare items with derived items are:

- Professional Attendances at an Institution: 4, 24, 37, 47, 58, 59, 60, 65, 5003, 5023, 5043, 5063, 5220, 5223, 5227, 5228

- Attendances at a Residential Aged Care Facility: 5010, 5028, 5049, 5067, 5260, 5263, 5265, 5267

- Others: 294

Adding a Medicare-derived item fee

To add a derived fee for a Medicare item:

- Complete the steps in the Update existing Medicare fees guide.

- Go to Zedmed's Management tab.

- Select Practice Setup then Items > Item Details.

The Find Item screen will open. - Enter the item number into the field provided and press enter.

The Item Selector screen will open. - Double-click the item.

It will open Item Details at the Standard tab. - Select the Details tab.

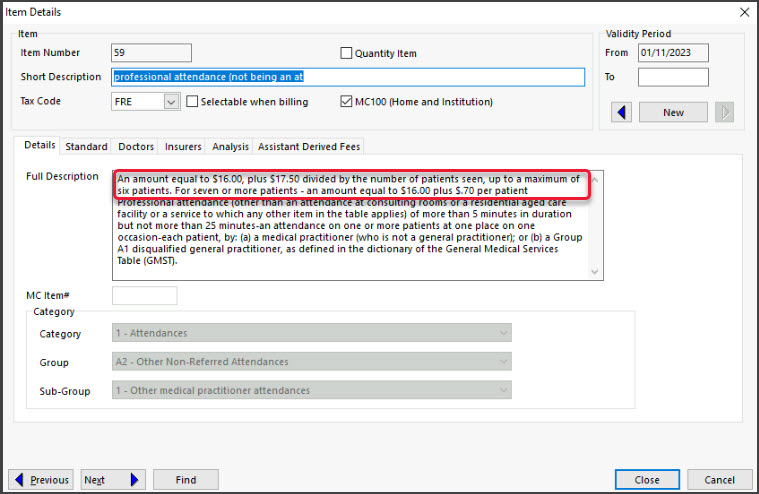

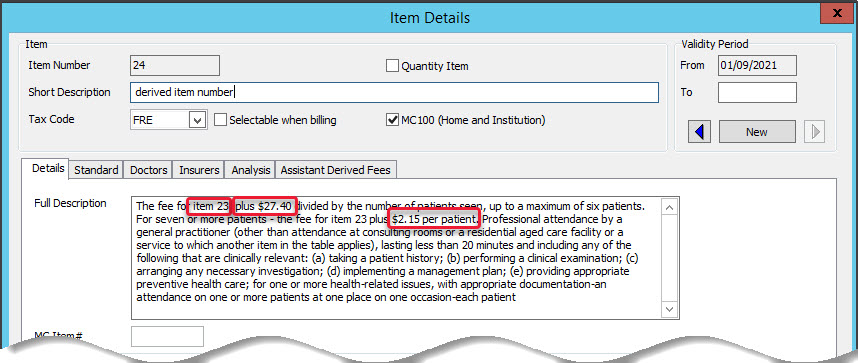

A derived item's fee can be calculated by:

• Including the associated item's fee in the calculation.

• Using only the values provided in the calculation.

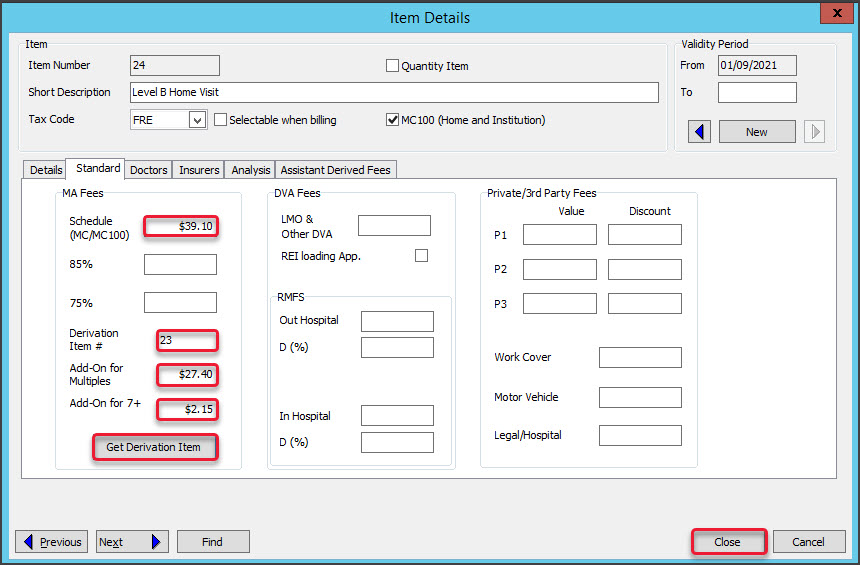

Including the associated item number

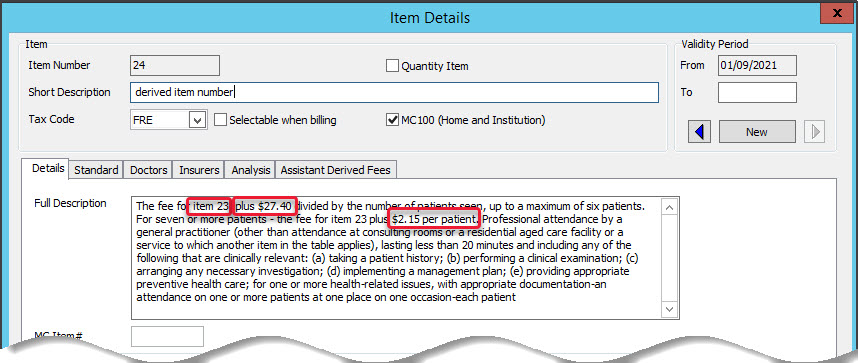

a) Note the following information: the derived item number, plus $ value and $ value per patient.

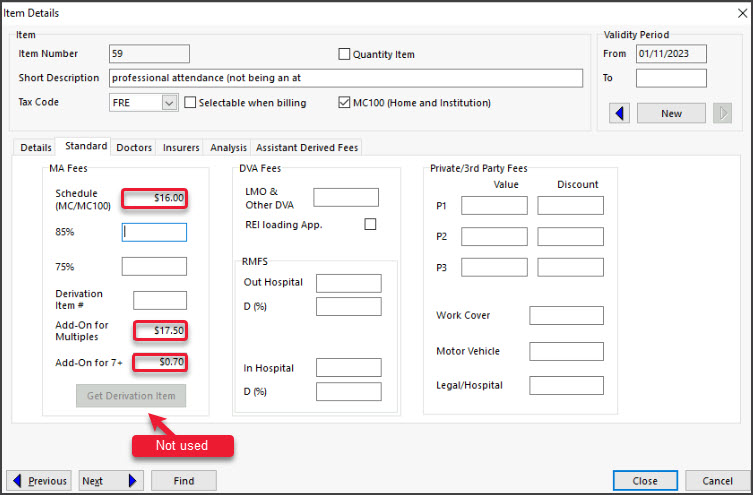

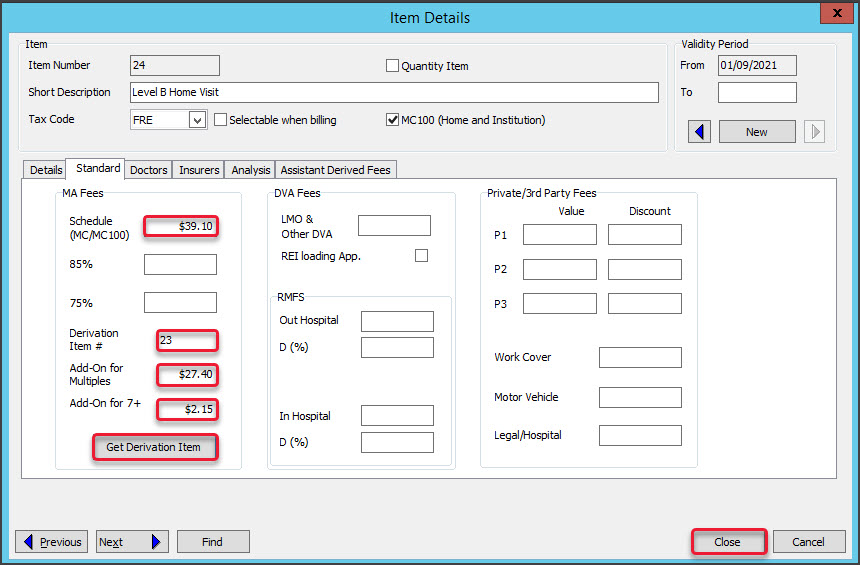

b) Select the Standard tab. c) In the Derivation Item field, enter the item number.

c) In the Derivation Item field, enter the item number.

d) In the Add-On for Multiples field, add the $ value.

e) In the Add-On for 7+, enter the plus $ value per patient.

f) Select the Get Derivation Item button.

The fee will be calculated and added to the Schedule field. Using only the values provided

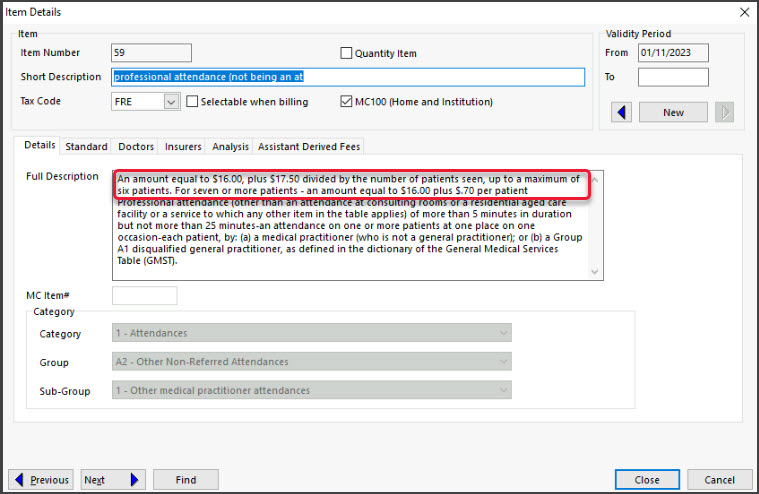

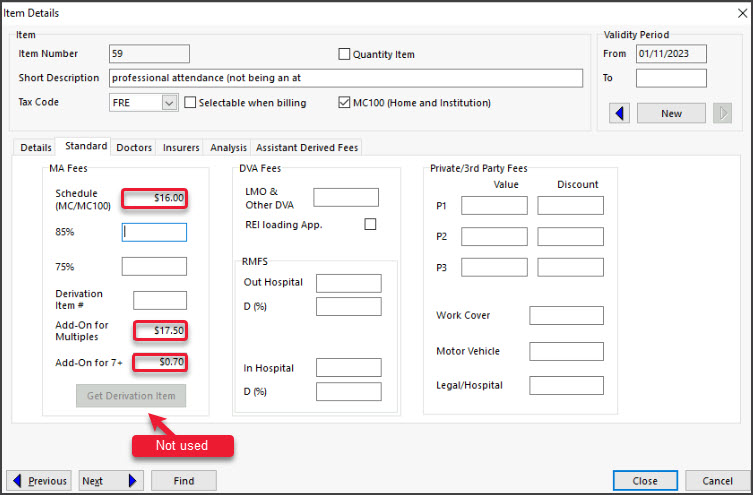

Using only the values provided

a) Note the values used for calculating the derived item fee.

b) Select the Standard tab.

c) In the Schedule field, enter the base amount's value.

d) In the Add-On for Multiples field, add the value to be divided by the number of patients.

e) In the Add-On for 7+, enter the amount per patient.

These fees will be applied to the invoice, Note, the total may be further modified by the % applied to the schedule.

- Select Close to save and exit.

When you raise an invoice for the derived item, a dollar amount will be applied and you will be prompted to enter the number of patients seen in the invoice Properties screen.

An invoice is to be raised for each patient that was seen, each time indicating the same number of patients in the Properties.

Updating a Medicare-derived item fee

MBS Fee File updates automatically update the Fees for derived items, but they do not update the Add-on for Multiples and Add-on for 7+ fields. These changes must be made manually after the MBS File update has been completed.

To update a derived fee's calculations:

- Go to Zedmed's Management tab.

- Select Practice Setup then Items > Item Details.

The Find Item screen will open. - Enter the item number into the field provided and press enter.

The Item Selector screen will open. - Double-click the item.

It will open Item Details at the Standard tab. - Enter any new value into the Add-On for multiples field.

- Enter any new value into the Add-On for7+ field.

- Select Get Derivation Item to update the Medicare Australia values.

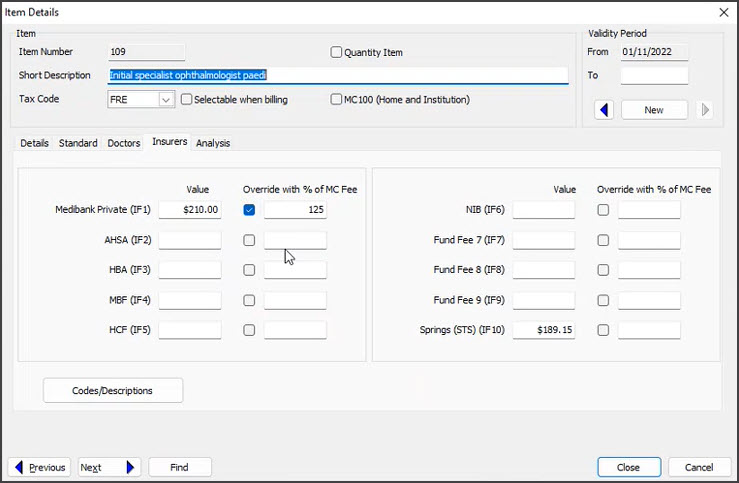

Adding an insurance-derived item fee

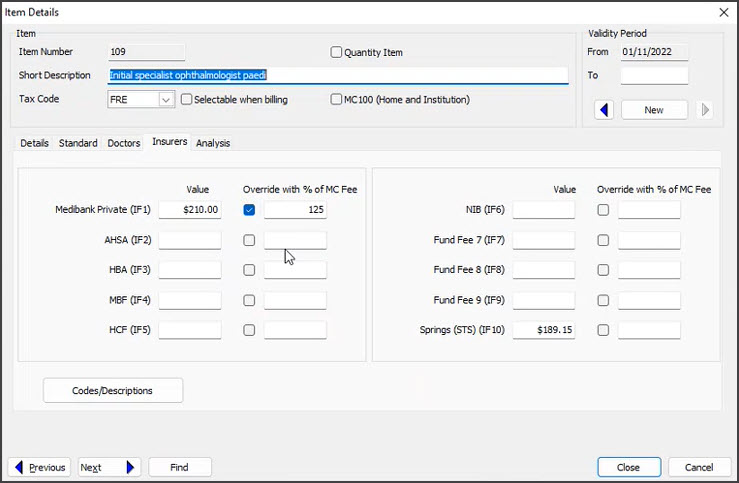

This feature will be available in Zedmed v35.8.1 and later, and automatically calculates derived item fees for Health Funds by applying a % adjustment to the standard fee of approved MBS Item numbers.

Note: An incorrect or invalid application of the override will result in the claim being rejected.

How the override applies to the selected fee type:

- If the override is not selected (or its field is empty), the insurer's Value will be used (the value from that fund's Fees File upload).

- If the override is used (ticked), a % modification will be applied to the standard Medicare fee for that item, and that will be the value used in the invoice.

To add a derived fee for a health fund:

- Go to Zedmed's Management tab.

- Select Practice Setup then Items > Item Details.

The Find Item screen will open. - Enter the item number into the field provided and press enter.

The Item Selector screen will open. - Double-click the item.

The Item Details screen will open. - Select the Insurance tab.

- Tick the box next to the Override field for the fee type.

- Enter the % adjustment into the Override with % of MC Fee field.

This will apply that adjustment to the Medicare item. For example, if the Medicare fee is $100 and the override adjustment is 120% - when that item is added to an invoice, the value will be $120. - Select Close to save the change.

We recommend testing that the item number shows the expected value when billing.

Adding MBS item 294

Support for Medical Benefits Schedule item 294 will be available in Zedmed v35.8.1 and later.

MBS item 294 has a value equal to 50% of the value of the preceding item in the invoice. Item 294 can only be applied to qualifying items if the required criteria are met, as described in the MBS guidance.

To add 294 to an invoice, add the qualifying item first, then add Item 294. You will see its value is 50% of the preceding item.

If any modifications are made to the qualifying item, the value of 294 will not automatically update. Therefore, the qualifying item and 294 need to be removed and readded if any changes are made.

Multiple operation rule (MOR)

Multiple operation billing applies if you bill 2 or more MBS items from Category 3, Group T8 for surgical services performed on a patient on one occasion.

Zedmed will automatically calculate and apply the discounts for you during billing.

The MOR is applied as defined by Services Australia:

- 100% of the fee for the item with the highest schedule fee

- plus 50% of the fee for the item with the next highest schedule fee

- plus 25% of the fee for any further surgical items.

To learn more, see the MSB Online Multiple Operation Rule page.

c) In the Derivation Item field, enter the item number.

c) In the Derivation Item field, enter the item number.

Using only the values provided

Using only the values provided